Tiffany Madon

Sep 10, 2020 - 4 Min read

Tiffany Madon

Sep 10, 2020 - 4 Min read

Notoriously slow to adopt innovation, the real estate industry has come a long way in a few short years. A revolution has taken place at the crossroads of big tech and traditional real estate, resulting in a booming Real Estate Tech industry. Dr. Liam Cheung, managing partner of Tactico, summarizes: “The number of PropTech decks we are evaluating has exploded in the past year. Beyond the natural overlap with our FinTech and LegalTech expertise, we have seen numerous other opportunities that span all sectors of property and real estate. The positive impacts of recent technological developments have barely begun to touch this sector”.

________________________________

PropTech, or Real Estate Tech, is generally understood as the use of technology to facilitate the buying, building, renting, selling, usage, maintenance, or management of real estate assets. It’s no wonder that VCs around the globe are actively seeking investments in this space, having poured over $30 billion dollars into PropTech in 2019 alone, a year-over-year growth rate of 227%.[1]

While PropTech was born as a subsegment of the FinTech movement, it has now evolved into a robust category of its own. As is often the case, solutions in the space have emerged quicker than the infrastructure to support them, resulting in a fragmented view of the PropTech segmentation and nomenclature. The following is an overview of the PropTech market segmentation according to Tactico as well as our views and investment approach to each of them.

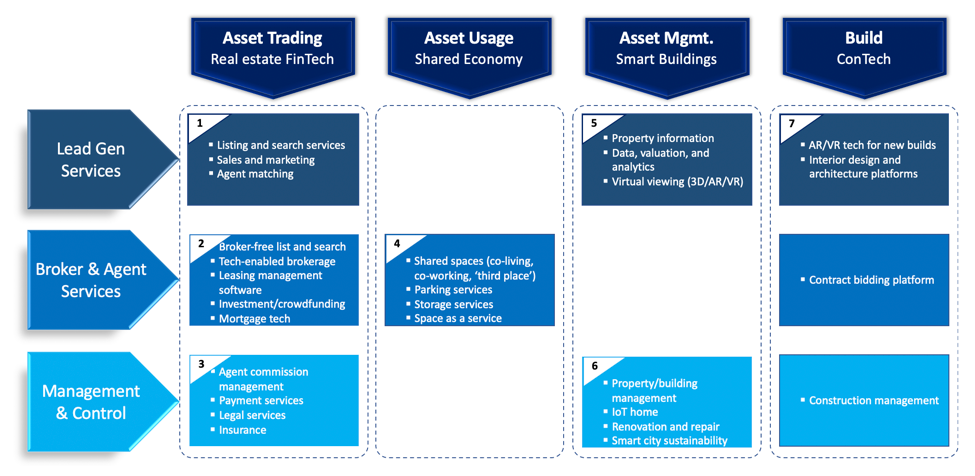

PropTech can be divided into four verticals, namely: Real Estate FinTech, Shared Economy, Smart Buildings, and ConTech,[2] and can be further broken down into horizontals, which we have assigned as Lead Gen Services, Broker & Agent Services, and Management & Control. The following matrix summarizes this segmentation:

This results in the identification of the following seven categories of interest to Tactico:

– Real Estate FinTech: Lead Gen Services – Serves brokers and consumers by providing data to generate matching leads for real estate assets, for both the purchasing and rental markets. Consumers of these services typically have low willingness to pay, as these services are viewed as a utility, thereby providing a public good. Incumbents like Zillow and Zoopla are large and powerful, so disruption can only come from companies with creative value propositions that service specific and likely high-value niches. Despite being a crowded and consolidated market, there is potential for exceptionally creative startups to succeed.

– Real Estate FinTech: Broker & Agent Services – These firms provide the matching and transactional aspects of a real estate/insurance/mortgage transaction. This segment can be further divided into broker-enabling services and disintermediating services. While tech-enabling the legacy industry is difficult, companies focused on disintermediation are well poised to take a share of the brokerage market fees with a redistribution of cost efficiencies between the consumer of the services and the firm’s bottom line. Disruptors in this segment have the potential to create value and reimagine asset transactions. Strong FinTech focus, especially in areas such as mortgage tech, investment/crowdfunding, and iBuyers.

– Real Estate FinTech: Management & Control – These firms provide tech-enabled solutions to simplify the management of real estate assets. With home buyers and sellers overwhelmed by legal and insurance paperwork involved in real estate asset trading, willingness to pay for convenience is high. Many value propositions in this space are still low-hanging fruit. This segment will continue to grow, branching out into InsurTech and LegalTech areas. Demand has been proven through unicorns like Lemonade and Hippo.

– Shared Economy: Broker & Agent Services – Although this segment is dominated by large incumbents (WeWork, Breather, Airbnb, Sonder), other areas remain fragmented and are expected to yield interesting opportunities (i.e. storage and parking). With urbanization on the rise, space-as-a-service offerings are growing steadily. While one-sided business models are asset-heavy, asset-light newcomers which could include two-sided platforms or marketplaces with enticing business models are appearing.

– Smart Buildings: Lead Gen Services – These companies use big data to collect and analyze information relating to real estate assets to aid in lead-gen for brokers or property managers. Virtual viewings, for example through 3D/AR/VR tech, have been growing in demand due to COVID and might become the new normal going forward. These may prove to be difficult to scale and take to the next level. Potential synergy with broker disintermediation as buildings become better connected, information will be easier to collect and to present directly to buyers and sellers.

– Smart Buildings: Management & Control – These firms connect building systems through smart networks, in order to build databases and extract insights. Trends include property manager desktop solutions, predictive and proactive IoT solutions, energy management systems, as well as commercial and residential medical/security monitoring. These SaaS opportunities offer reductions in administration and utility costs, and further provide technology to meet the new demands of changing workplaces and homes.

– ConTech – These firms are traditionally low-tech, with a lack of innovation leading to low productivity, or are otherwise difficult to scale. The highly consolidated industry results in high bargaining power for suppliers. These factors make it a prime target of disruption, but there is much uncertainty as to when that will happen. Any opportunities in this space would require advisors with industry specific knowledge on the particular applications to the construction industry.

We encourage you to continue to follow our blog posts, where we intend to share our investment strategy and views. Join our platform for updated opportunities as investors and entrepreneurs alike: www.tactico.com/sign-up

Tactico Inc. (“Tactico”) is a venture capital firm specializing in direct investments in cash flow positive, small-cap entities or start-up firms through a combination of debt, preferred shares or common shares with the intent to create long-term value. Tactico’s investment philosophy is governed by the belief that value can be created through direct involvement in management or through funding where cash-flow requirements can improve competitive positioning. Tactico intends to provide close support to current management and may name representatives to the Board of Directors of its portfolio companies.

[1]CRETech 2019 End-Year Report, https://www.cretech.com/directory/company/cretech/press-release/cretech-releases-2019-end-year-report-on-state-of-the-commercial-real-estate-tech-sector, page 13

[2]https://www.sbs.ox.ac.uk/sites/default/files/2018-07/PropTech3.0.pdf